In crypto, a protocol’s future often lives and dies by its token design. You can have great technology, a smart team, and even early hype — but if your tokenomics are broken, the system eventually collapses under its own weight.

At its core, tokenomics is the economic engine of a protocol — the rules that decide who earns what, when, and why. It determines whether your token becomes a valuable asset that grows with the ecosystem, or inflationary trash that bleeds out value as more tokens flood the market.

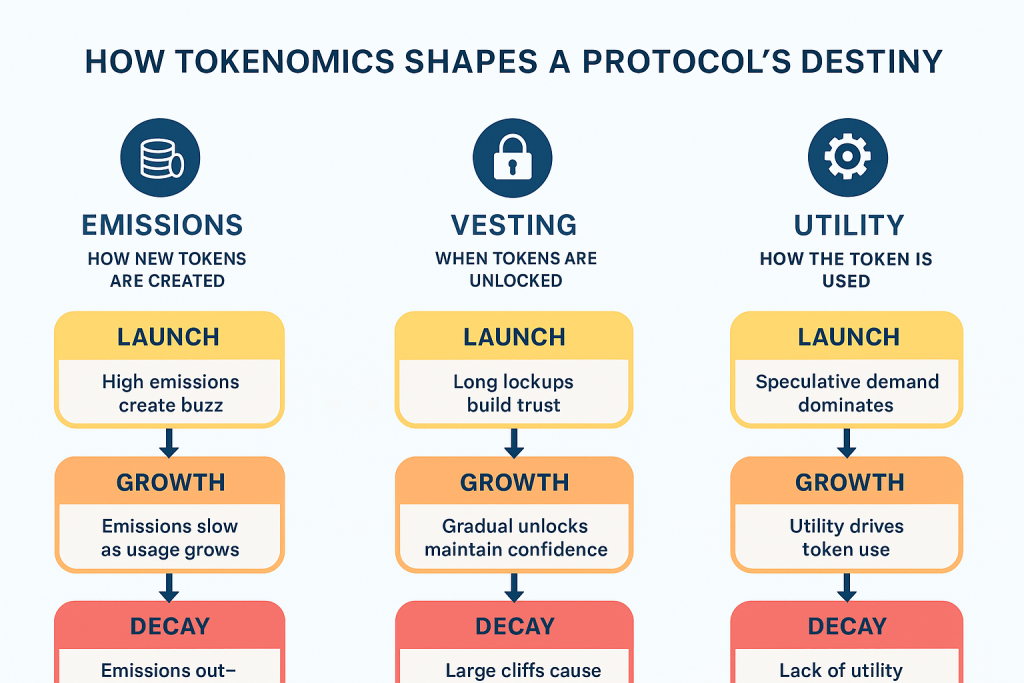

Three core pillars shape this destiny:

- Emissions — how new tokens enter circulation (supply).

- Vesting — how early investors and team allocations unlock over time.

- Utility — the real, repeatable reason people hold or use the token.

Let’s dive into how each of these pillars influence the direction and the lifespan of a protocol.

1. Emissions: New life or forever leaks.

Emissions refer to how new tokens are created and distributed — through staking rewards, yield farming, liquidity mining, or validator incentives.

Why It Matters:

Emissions control how fast the money printer runs. High emissions can attract users early (liquidity, attention, growth), but if too many tokens flood the market without matching demand, value gets diluted.

Impact on Life Cycle:

- Launch Phase: High emissions create buzz — “farmers” rush in for free rewards.

- Growth Phase: If emissions slow down and usage grows, price stabilizes and trust builds.

- Decay Phase: If rewards outpace real utility, sell pressure kills price momentum, and liquidity dries up.

Think of emissions like watering a plant — too little and it dies, too much and it drowns.

Good Example:

- Curve Finance ($CRV)— uses emissions to incentivize liquidity while governance controls where rewards flow (via veCRV model).

Bad Example:

- Many 2021 yield farms — printed millions of tokens per week, leading to hyperinflation and collapse.

2. Vesting — The Trust Mechanism

Definition:

Vesting determines when insiders (founders, team, investors) can access and sell their tokens. It’s the schedule that releases locked allocations over time.

Why It Matters:

A fair vesting schedule signals long-term alignment. If insiders can dump early, it shows they don’t believe in the project’s future — and that erodes trust instantly.

Impact on Life Cycle:

- Launch Phase: Long lockups give retail users confidence that insiders won’t dump.

- Maturity Phase: Gradual unlocks can be absorbed by market demand if the project grows.

- Crash Phase: If large cliffs (big unlocks) hit when demand is weak, the price collapses.

Analogy:

Vesting is like releasing pressure slowly from a bottle — do it right, and the system stays stable; open it all at once, and it explodes.

Good Example:

- Aptos & Arbitrum have transparent vesting schedules to maintain investor trust.

Bad Example:

Gala Games ($GALA, 2022)

- What happened:

Gala’s team unlocked a massive portion of tokens much earlier than the community expected. The unlock schedule wasn’t clearly communicated — and when tokens started hitting exchanges, the market saw heavy insider selling. - Result:

Price tanked, community outrage exploded on X and Discord, and trust in the token’s fairness evaporated overnight.

3. Utility — The Core Value Driver

Utility is what gives the token a reason to exist beyond speculation. It’s the set of real actions users can perform with the token — pay fees, stake for yield, vote in governance, or unlock services.

Why It Matters:

Without strong utility, a token is just a trading chip. With it, the token becomes the fuel of the ecosystem, driving activity, retention, and value accrual.

Impact on Life Cycle:

- Launch Phase: Speculative demand dominates (people buy because they expect price to rise).

- Growth Phase: Utility kicks in — tokens get used for governance, fees, or staking.

- Maturity Phase: The ecosystem relies on the token as infrastructure — it gains “monetary gravity.”

Think of utility as the engine under the hood — it keeps the car moving after the hype fades.

Good Example:

- Ether (ETH) — powers gas fees, staking, and DeFi collateral — real utility = sustained value.

Bad Example:

- Tokens with “no use case” except farming rewards or governance over an inactive protocol like Safemoon ($SFM). It launched in early 2021 during the DeFi and meme coin boom. It promised “automatic liquidity,” “token burns,” and “holder rewards” — but beyond those buzzwords, the token had no actual use case.

There was no product, no protocol, and no reason to hold the token except the hope that someone else would buy it at a higher price.

Final Words.

A protocol’s destiny isn’t decided by hype or marketing — it’s written in its tokenomics code.

- Emissions decide how fast value enters circulation.

- Vesting decides who controls the flow and when.

- Utility decides whether the ecosystem actually needs the token to function.

Get all three right, and you have a sustainable economy. Get them wrong, and the token becomes short-lived noise in an already crowded market.